What is the Future of Fintech in Bangladesh?

How will fintech shape the economic landscape in Bangladesh? Let’s know more about the future of Fintech in Bangladesh.

FinTech is a short word for ‘Financial Technology’ which is the concept of digitization within the financial services industry. With the growing number of users of smartphones and the internet, the fintech industry is developing day by day.

In recent years, many new Fintech Startups have emerged. The government has also contributed much to fintech development.

In this blog, I’ll try to describe the future of Fintech in Bangladesh.

What is the Future of Fintech in Bangladesh?

The future of fintech in Bangladesh looks bright. Bangladesh has a large and growing population with increasing access to the internet and smartphones, which gives a strong foundation for fintech development.

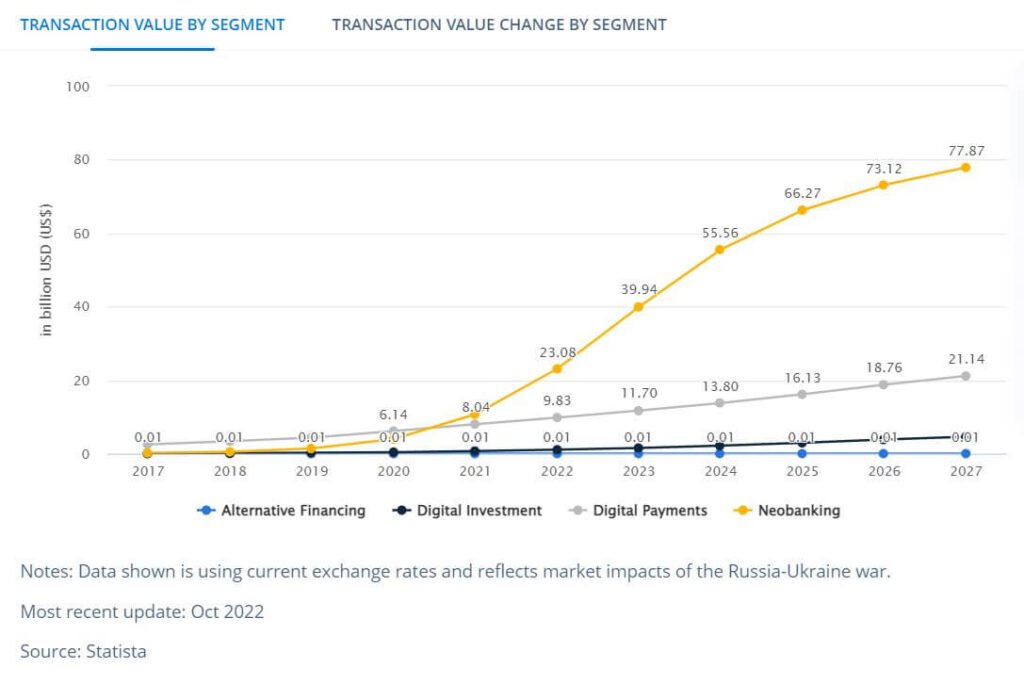

According to the Bangladesh Fintech report by Statista, Neobanking is expected to show a revenue growth of 73.1% in 2023. The number of users of digital payment is expected to be 85.62 million by 2027. The amount of digital investment is also expected to be 77.87 billion USD by the next 5 years.

Though Bangladesh is still behind other developed countries in technology, fintech, and digital banking, it has a bright future in Fintech. As per The Global Fintech Index, currently Bangladesh holds the 78th ranking.

Bangladesh’s government has already taken steps to support the Fintech industry in this country. Very recently The central bank of Bangladesh launched “Binimoy“, an interoperable digital transaction platform, that will make mobile banking transactions more flexible.

Fintech companies in Bangladesh are focusing on a range of services, including Digital Banks, peer-to-peer lending, wealth management, and insurance. There is also a growing demand for fintech solutions in the agriculture and small and medium-sized enterprise (SME) sectors.

The adoption of fintech in Bangladesh has the potential to transform the lives of people, improve financial inclusion, increase access to financial services, and drive economic growth ultimately.

What Changes Bangladesh Will See in Near Future

Financial technology is a fast-growing industry in Bangladesh. In recent years, there have been several developments in this sector along with government steps. Here are a few more things that you can see in the fintech growth in Bangladesh:

- Increased Adoption of Mobile Banking;

- More digital payment systems;

- Growth of more online lending platforms;

- Increase of Neobanking transactions;

- Increase in Digital Investment;

Main Challenges to Fintech Growth in Bangladesh

There are some challenges to growing the Fintech industry in Bangladesh. If Bangladesh could look after these factors, it could develop its fintech industry faster.

1. Technology

Bangladesh remains always behind to adopt new technologies. Fintech is based on technology. So the faster we can adopt new technologies, the faster our fintech will grow. We should also focus on increasing our young internet users and mobile subscribers to adopt Fintech.

2. Digital Literacy

A major part of our population is from rural areas. The more people fintech companies can serve, the more they can grow. But most people in rural areas are not fully aware of digital banking and transactions. They don’t like digital payments and online banking, they feel safe with a cash transaction.

Here, Bangladesh should take the initiative to make literate her people in digital payment, its safety, and its benefits.

3. Innovation

In Bangladesh, innovation is not rewarded properly. Besides, there is not enough facility or platform to introduce innovations by individuals or organizations.

Government can organize Fintech Innovation Challenge Programme where fintech firms and individuals can take part to introduce their innovations.

Bottom Line

However, there are some challenges to the development of fintech in Bangladesh, such as a lack of regulatory clarity, limited access to credit and capital, and low levels of digital literacy.

To realize the full potential of fintech in Bangladesh, it will be important for the government, industry, and other stakeholders to address these challenges and work together to create a supportive ecosystem for fintech innovation.